Stay ahead of the curve with our informative blogs covering everything from Bullion Standard trends to expert analysis. Silver bullion coins are a great way to diversify your investment portfolio and provide a hedge against economic uncertainty.

Quick Overview Both gold and silver have served as effective hedges against inflation and economic downturns, maintaining value over time. Financial experts often recommend allocating a portion of your investment…

Quick OverviewHistorically, platinum has often been more expensive than gold due to its rarity and industrial applications.Prices for both metals are subject to market fluctuations influenced by factors such as…

Quick Overview Gold has been valued since ancient times for its brilliance and rarity, serving as currency, jewelry, and a symbol of wealth across various civilizations. Its unique metallic properties,…

Quick OverviewWealth Preservation: Precious metals have historically maintained their value over time, serving as a reliable store of wealth and a hedge against inflation.Low Correlation with Traditional Assets: Gold and…

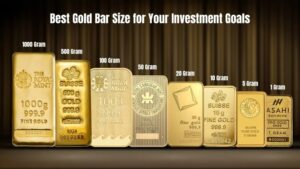

Quick OverviewPhysical Gold: Purchasing tangible assets like gold coins, bars, or jewelry allows for direct ownership. This method provides a sense of security and control but requires secure storage and may…

Quick Overview Investing in precious metal bullion, such as gold, silver, and platinum, offers a tangible asset that can serve as a hedge against inflation and economic uncertainties. Before purchasing,…

The best gold bars to buy for a sound investment Gold has always symbolized wealth, power, and permanence—but that hasn't stopped it from becoming the ultimate prize for thieves. Some…

The best gold bars to buy for a sound investment Investing in gold bars is a time-honoured strategy for securing financial stability and growing wealth. Whether you’re a novice investor…